48++ How Do I Change My Llc To An S Corp info

How do i change my llc to an s corp. They often do this because its presumably easier to create and run an LLC over an corporation. You can submit the documents necessary to convert your LLC to an S-Corp for tax purposes along with your tax return. To make an LLC to S corp. Depending on your state you can effectuate this change through a conversion or merger. The limited liability company business form is a state entity taxed for income tax purposes as either a sole proprietorship one owner or a partnership multiple owners. Establish a single-member limited liability company LLC assuming that you havent done so. Download IRS Form 8832 - Entity Classification Election - from the forms section of the IRS website. While this may be true the extra paperwork is worth it. The filing of the initial Form 1120-S return will finalize the change of the entitys filing requirement on the Internal Revenue Services records. Changing Tax Type for an LLC. Follow these steps to convert a corporation into an LLC in the same state. Election with the IRS you need to file form 2553 Election by a Small Business Corporation.

Once the LLC is classified for federal tax purposes as a Corporation it can file Form 2553 to be taxed as an S Corporation. The process of changing the tax status of an LLC to a corporation or S corporation is called an election. Sign and date the form. A generic operating agreement used for a typical LLC is not appropriate because it does not address the specific provisions of the tax code dealing with S corporate. How do i change my llc to an s corp Citizen or equivalent converting to an S corporation is relatively simple. This procedure can differ depending on the state where you are located but many states simply require you file a form with the Secretary of State for your operating state. The form must be signed by shareholders and an officer of the company. They can help them convert to a corporation. The two processes are different. If you started your business as a limited liability company LLC but have since decided that it is better for your business to run it as an S corporation or S corp it is possible to make the change. For various reasons you may decide to have your LLC taxed as a corporation or S corporation. How to convert an LLC to S Corporation For federal tax purposes you can simply make an election for the LLC to be taxed as an S Corporation. All you need to do is fill out a form and send it to the IRS.

How Starting An S Corp Could Lower Your Taxes By 5 000 Tax Savings Calculator Gusto

How do i change my llc to an s corp The LLC tax as an S corporation may require the assistance of a tax advisor andor attorney to complete depending on how comfortable you are with the forms and documentation.

How do i change my llc to an s corp. To elect Corporation status the LLC must file IRS Form 8832 - Entity Classification Election. Therefore the states conversion law does not require you to dissolve the corporation. By Larissa Bodniowycz JD.

File a Certificate of Conversion with the state agency that has jurisdiction over businesses in your state usually the Secretary of State. In some situations your election to be taxed as an S-Corp might not be effective until the following tax year so the rest of your tax return should reflect this fact if it applies. In order for the entity to be changed from an LLC to a corporation the business will need to file with the state agency who is in charge of corporate filings.

Many people mistakenly set up a single member LLC when they should be using an S corporation. Fill out the form following the instructions provided. To elect S Corporation status the LLC must file IRS Form 2553 - Election by a Small Business Corporation.

When an LLC wants to be an S corporation instead they will need to formally change their entity type with the formation state. File the S corporation return Form 1120-S by the due or extended due date. The Certificate of Conversion describes the old entity the corporation and the new entity you want an LLC.

By March 15 of the year you want the election to take effect. Some corporate taxpayers are required to file electronically. Most states have an easy process for changing from an S corporation to an LLC.

If your business is operating as a sole proprietorship and youre a US. This LLC will be your legal entity structure. Converting a single member LLC to an S corp may be a good move for many small business operators.

Indicate as directed that you are changing your tax structure designation from corporation to sole proprietorship. If you want your election to be effective for the entire tax year it should be filed. In some states you must first form your LLC and then merge the S corporation into the existing LLC.

How do i change my llc to an s corp In some states you must first form your LLC and then merge the S corporation into the existing LLC.

How do i change my llc to an s corp. If you want your election to be effective for the entire tax year it should be filed. Indicate as directed that you are changing your tax structure designation from corporation to sole proprietorship. Converting a single member LLC to an S corp may be a good move for many small business operators. This LLC will be your legal entity structure. If your business is operating as a sole proprietorship and youre a US. Most states have an easy process for changing from an S corporation to an LLC. Some corporate taxpayers are required to file electronically. By March 15 of the year you want the election to take effect. The Certificate of Conversion describes the old entity the corporation and the new entity you want an LLC. File the S corporation return Form 1120-S by the due or extended due date. When an LLC wants to be an S corporation instead they will need to formally change their entity type with the formation state.

To elect S Corporation status the LLC must file IRS Form 2553 - Election by a Small Business Corporation. Fill out the form following the instructions provided. How do i change my llc to an s corp Many people mistakenly set up a single member LLC when they should be using an S corporation. In order for the entity to be changed from an LLC to a corporation the business will need to file with the state agency who is in charge of corporate filings. In some situations your election to be taxed as an S-Corp might not be effective until the following tax year so the rest of your tax return should reflect this fact if it applies. File a Certificate of Conversion with the state agency that has jurisdiction over businesses in your state usually the Secretary of State. By Larissa Bodniowycz JD. Therefore the states conversion law does not require you to dissolve the corporation. To elect Corporation status the LLC must file IRS Form 8832 - Entity Classification Election.

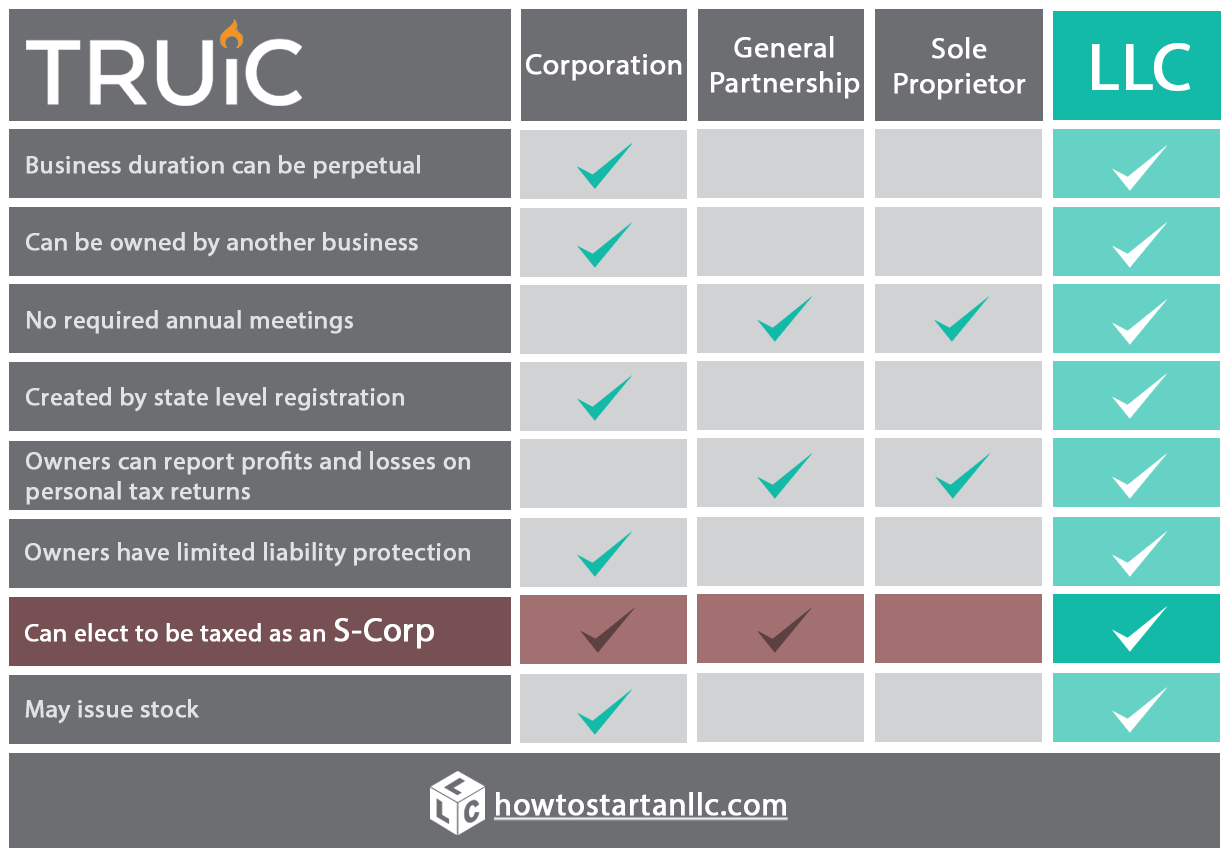

What Is The Difference Between S Corp And C Corp Business Overview