10++ How Did Black Tuesday Affect Rich And Middle Class Investors info

How did black tuesday affect rich and middle class investors. Black Tuesday October 29 1929 This date signaled a selling frenzy on Wall Street--days before stock prices had plunged to desperate levels. People panicked and withdrew their money from banks but some could not get their money back because the bank invested in the stock market which crashed. For African Americans the public sector was a key path toward financial stability. This Black History Month were highlighting 27 founders and investors who are leaving their marks on venture capital and tech. Stock market came crashing down initiating the most severe economic crisis in US. White workers who could get high-quality jobs in the private sector had multiple doors open to them. The rich spend more on education. It is also depriving the black community of investment and leadership from some of. Black achievement doesnt consider the obvious disparity between the black middle class and their lower income peers individuals who feel no connection to the success of their favorite uncle auntie or childhood best friend and as such resent the profiles of their communities and their situations as something less than a fertile ground for developing a strong character and work ethic that can propel. October 29 1929 or Black Tuesday marks the day the US. The migration of middle-class African-Americans is helping to depress already falling housing prices. On October 29 1929 Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day.

Banks closed and failed because the government did not protect or insure bank accounts. The study also found a higher level of investment in real estate outside of the primary home 41 of non-financial assets versus just 22 for whites in the same income bracket. On Black Monday the computerized trading systems created a domino effect continually accelerating the pace of selling as the market dropped thus causing it to drop even further. Investors were willing to sell their shares for pennies on the dollar or were simply holding on to the worthless certificates. How did black tuesday affect rich and middle class investors The avalanche of selling that was triggered by the initial losses resulted in stock prices dropping even further which in turn triggered more rounds of computer-driven selling. Homeownership and retirement savings. On what became known as Black Thursday false reports crackled around Wall Street that distraught bankers and investors were leaping out of high-rise windows and plummeting as quickly as the. After this devastating week prices continued in freefall wiping out an estimated 30 billion in stock value by mid-November 1929. The Black Death was widely interpreted as a punishment from God for Europes sinfulness and many post-plague writers blamed the church governments and wealthy companies for. The poor spend more of their money on essentials like groceries and utilities. Speculation the practice of investing in risky financial opportunities in the hopes of a fast payout due to market fluctuations. What was the unemployment rate during most the depression. From Black Thursday to Black Tuesday the stock market lost over 26 billion in value and over 30 million shares were traded.

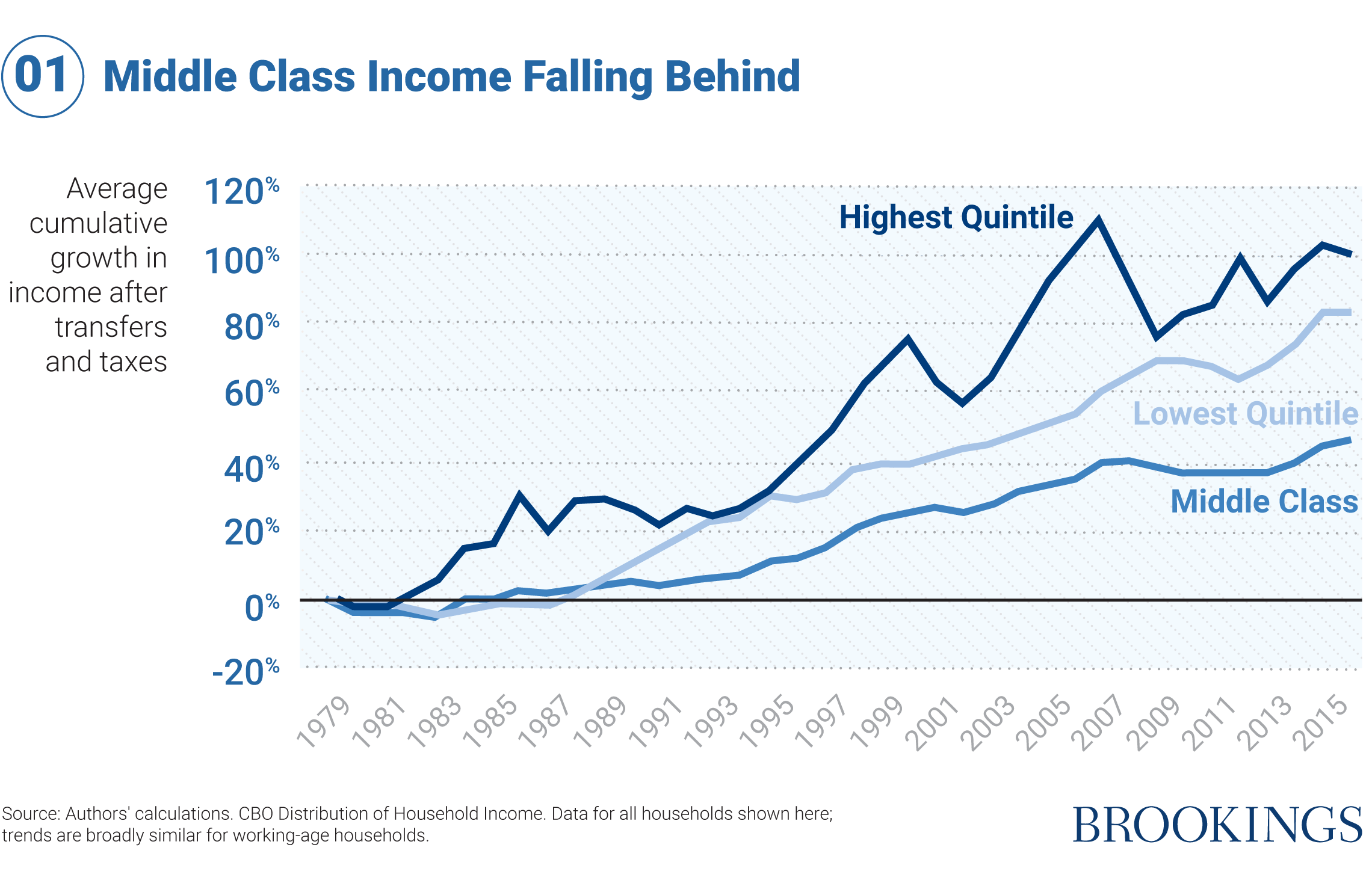

Covid 19 Economic Mobility Racial Justice And The Middle Class

Covid 19 Economic Mobility Racial Justice And The Middle Class

How did black tuesday affect rich and middle class investors Depression Here we examine commentary and political cartoons that illustrate this pivotal moment in American history.

How did black tuesday affect rich and middle class investors. The middle class has more debt to pay off which makes it. Founder of Cineshares a platform that exhibits films for crowdfunding and founding partner and managing director at impact-focused VC firm DiverseCity Ventures. It can be argued that the pivotal moment was not October 29Black Tuesdaybut some instant later when the nation as a whole realized the economy was not going to bounce back prosperity had left the scene and a bleak new reality had arrived.

Black Tuesday October 29 1929 when a mass panic caused a crash in the stock market and stockholders divested over sixteen million shares causing the overall value of the stock market to drop precipitously. But public-sector expansion helped build a black middle class across the country. History now known as.

Two clear divides emerged along traditional markers of wealth. The black middle class is disproportionately linked to governmental employment Lichtenstein said.

How did black tuesday affect rich and middle class investors The black middle class is disproportionately linked to governmental employment Lichtenstein said.

How did black tuesday affect rich and middle class investors. Two clear divides emerged along traditional markers of wealth. History now known as. But public-sector expansion helped build a black middle class across the country. Black Tuesday October 29 1929 when a mass panic caused a crash in the stock market and stockholders divested over sixteen million shares causing the overall value of the stock market to drop precipitously. It can be argued that the pivotal moment was not October 29Black Tuesdaybut some instant later when the nation as a whole realized the economy was not going to bounce back prosperity had left the scene and a bleak new reality had arrived. Founder of Cineshares a platform that exhibits films for crowdfunding and founding partner and managing director at impact-focused VC firm DiverseCity Ventures. The middle class has more debt to pay off which makes it.

How did black tuesday affect rich and middle class investors

The Stock Market Crash Of 1929 Us History Ii Os Collection

The Stock Market Crash Of 1929 Us History Ii Os Collection