41++ How Do I Find My State And Local Tax Rate ideas in 2021

How do i find my state and local tax rate. Sales and Use Tax. Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. State Sales Tax Average Local Sales Tax By State Choose any state for a list of local sales taxes. Use this map to find information on your states income sales property estate and other taxes. The state has 10 tax brackets for 2021 starting with a 1 bracket for income up to 8932 and ending with a 133 tax rate for income in excess of 1 million for single filers. Combined Rates Five states do not have statewide sales taxes. Average of local sales taxes as of January 1 2020 to give a sense of the average local rate for each state. Your household income location filing status and number of personal exemptions. States may tax the sale of goods and services. Choose a state from the table below for a list of all cities counties and districts within the state that collect a local option sales tax. This level of accuracy is important when determining sales tax rates. Whats your state tax rate.

You can find out the total sales tax rate in your area - including state county and local - here. From there it can determine the corresponding sales tax rate by accessing AvaTax our innovative cloud-based sales tax calculation product. The rate you use will depend on your state and county. Check whether your business has to register to pay andor collect sales tax in your state. How do i find my state and local tax rate States may also tax your business on the use of goods and services when sales tax has not been collected. This will return a value into your Federal return. In some states the sales tax rate stops there. These usually range from 4-7. 52 rows State SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama. How do I find the Total State and Local Rate. Michigan then youd just charge them the Michigan state sales tax rate of 6. Click the link below for your state and then your citycounty to find your sales tax rate that you should enter into TurboTax. Table 1 provides a full state-by-state listing of state and local sales tax rates.

Savic Crsf My Location Bill From And Tax Rates

How do i find my state and local tax rate The other states though also allow local areas such as counties and cities to set a sales tax rate.

How do i find my state and local tax rate. Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income taxWhile most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code. Exclusions in sales tax often include food clothing medicine newspapers and utilities. You will pull down the drop box and input the state that you reside in and the number of days you lived in that state during the tax year then enter the amount of sales taxes you paid for qualifying large purchases up to the of sales tax at your regular rate then input your state tax rate and local tax rates.

For example the state rate in New York is 4 while the state sales tax rate in Tennessee is 7. 35 rows To learn more about how your state income tax rates work visit the website of. Ten states dont have local sales tax rates so if you make a sale to a buyer in one of those states Ex.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Find out about state tax rates here. This is asking for the applicable sales tax rate in your primary residence in order to calculate your potential sales tax deduction.

When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction.

How do i find my state and local tax rate When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction.

How do i find my state and local tax rate. This is asking for the applicable sales tax rate in your primary residence in order to calculate your potential sales tax deduction. Find out about state tax rates here. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Ten states dont have local sales tax rates so if you make a sale to a buyer in one of those states Ex. 35 rows To learn more about how your state income tax rates work visit the website of. For example the state rate in New York is 4 while the state sales tax rate in Tennessee is 7. You will pull down the drop box and input the state that you reside in and the number of days you lived in that state during the tax year then enter the amount of sales taxes you paid for qualifying large purchases up to the of sales tax at your regular rate then input your state tax rate and local tax rates. Exclusions in sales tax often include food clothing medicine newspapers and utilities. Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income taxWhile most states use a marginal bracketed income tax system similar to the federal income tax every state has a completely unique income tax code.

How do i find my state and local tax rate

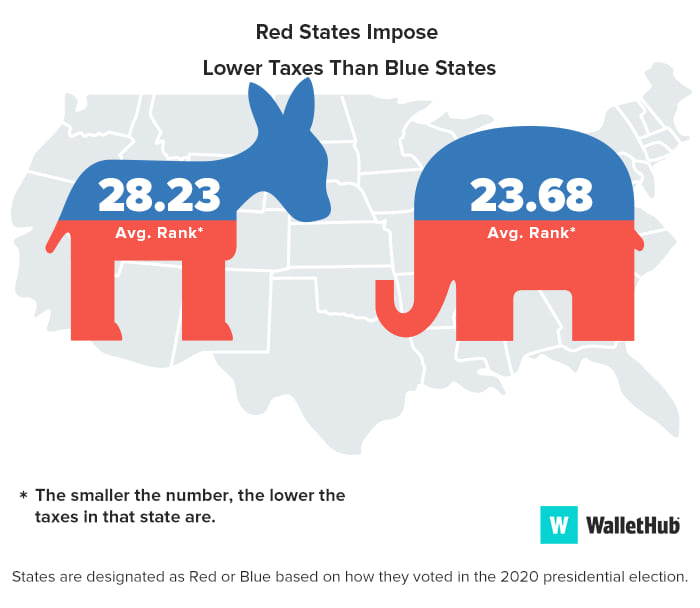

States With The Highest Lowest Tax Rates

States With The Highest Lowest Tax Rates