42+ How Do You Remove Late Payments From Your Credit Report information

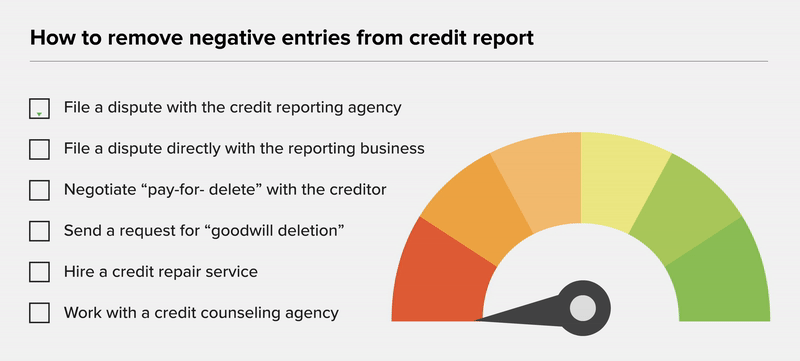

How do you remove late payments from your credit report. That being said its better to have a debt reported as paid instead of a charge-off. Write your creditorssimplified Credit Repair Credit Lifestyle 101 Powered By. As a result they can legally report you as 30 days late on your payment. Call your lender on the phone and ask to have the payment deleted. Late payments make it hard to get credit moving forward. If they determine they reported the late payment by mistake they can contact the credit reporting companies to have it removed. If the late payment does actually belong to you you may be able to get it removed by the bank with a goodwill letter. After you have gathered this information you want to see if there is any blame you can pin on the creditor. Simply write another letter or even better get a customer service manager on the phone or via email or web engagement and ask that the company remove your late payment from your credit report. Keep reading to find out how to remove a late payment from your credit report and rebuild your credit moving forward. For accounts with balances the pay for delete strategy can help you remove a closed account from your credit report. Not everyone is able to pay debts on time but while this is not out of the ordinary it is harmful.

In essence all negative items have a specific amount of time they can hang around your credit reports after which time they have to be removed. Thereby you would have been 38 days late. Find out if the late payment was due to any of the following issues. How to remove late payments from your credit report. How do you remove late payments from your credit report A single late payment can drop an excellent credit score 750 and above by over 100 points. That should remove the information at the source so that it wont come back later. Paying off your debt is an option to consider if your lender or collections agencies wont negotiate with you. However simply paying off the debt wont remove it from your credit report. If a late payment is on your credit reports in error you can get it removed with a dispute relatively easily. Here are 3 proven ways to remove late payments from your credit report. Check Your Credit Report to See if the Late Payments. Credit Card Insider receives compensation from advertisers whose products may be mentioned on this page. Having late payments on your credit report could seriously affect your credit score and you may even end up being unable to obtain certain benefits because of it.

How To Remove Late Payment From My Credit Report Credit Repair Com

How To Remove Late Payment From My Credit Report Credit Repair Com

How do you remove late payments from your credit report If this has happened to you youre probably asking yourself how to remove late payments from your credit report.

How do you remove late payments from your credit report. Wait for the Late Payment to Age Off of Your Report At the end of the day the only surefire way for a late payment to be removed from your credit report is for it to naturally age off. You can also contact the original creditor directly to voice your concern and ask them to investigate. You can request the change in two ways.

9 The pay-for-delete letter offers full payment of the outstanding in exchange for removing the account from your credit report. This is an ideal option if you generally have a good payment history with your creditor and have been a customer for a while. It can remain on your credit report for seven years.

Pay for Delete. Request a Goodwill Adjustment from the Creditor Negotiate to Remove a Late Payment by Signing Up for Auto-Pay Dispute the Late Payment Entry on Your Credit Report as Inaccurate. Find out how to remove a late payment from your credit report.

Send these to each of the credit bureaus reporting the erroneous information. The simplest approach is to just ask your lender to take the late payment off your credit report. Request a Goodwill Adjustment.

Here is an overview of four ways you can successfully remove a late payment from your credit report. In your letter you should identify the error in question and ask for them to remove the entire entry from your credit report. You can send these either by mail or online.

They hurt your credit score sometimes a lot and make future lenders wary about lending you money. In this Article. If you only take a single credit maxim to heart it should be to always pay your bills on time.

How to Remove Late Payments from a Credit Report Posted by Frank Gogol. Increase Your Credit by 100 Points In a recent study at Credit Knocks we found that 48 of clients who used a credit repair company got a credit score increase of 100 points.

How do you remove late payments from your credit report Increase Your Credit by 100 Points In a recent study at Credit Knocks we found that 48 of clients who used a credit repair company got a credit score increase of 100 points.

How do you remove late payments from your credit report. How to Remove Late Payments from a Credit Report Posted by Frank Gogol. If you only take a single credit maxim to heart it should be to always pay your bills on time. In this Article. They hurt your credit score sometimes a lot and make future lenders wary about lending you money. You can send these either by mail or online. In your letter you should identify the error in question and ask for them to remove the entire entry from your credit report. Here is an overview of four ways you can successfully remove a late payment from your credit report. Request a Goodwill Adjustment. The simplest approach is to just ask your lender to take the late payment off your credit report. Send these to each of the credit bureaus reporting the erroneous information. Find out how to remove a late payment from your credit report.

Request a Goodwill Adjustment from the Creditor Negotiate to Remove a Late Payment by Signing Up for Auto-Pay Dispute the Late Payment Entry on Your Credit Report as Inaccurate. Pay for Delete. How do you remove late payments from your credit report It can remain on your credit report for seven years. This is an ideal option if you generally have a good payment history with your creditor and have been a customer for a while. 9 The pay-for-delete letter offers full payment of the outstanding in exchange for removing the account from your credit report. You can request the change in two ways. You can also contact the original creditor directly to voice your concern and ask them to investigate. Wait for the Late Payment to Age Off of Your Report At the end of the day the only surefire way for a late payment to be removed from your credit report is for it to naturally age off.

Late Payments On Your Credit Report Here Is How To Remove Them Credit Marvel

Late Payments On Your Credit Report Here Is How To Remove Them Credit Marvel