18+ 1099 B Proceeds From Broker And Barter Exchange Transactions Turbotax Information

1099 b proceeds from broker and barter exchange transactions turbotax. On smaller devices click in the upper left-hand corner then click Federal. Form 1099-B Proceeds from Broker and Barter Exchange Transactions reports the sale of stocks bonds mutual funds and other securities. Follow the specific instructions for brokers or barter exchanges for example the reporting of basis for a QOF investment that is a covered security. For whom the broker has sold including short sales stocks commodities regulated futures contracts foreign currency contracts pursuant to a forward contract or regulated futures contract forward contracts debt. To enter Form 1099-B information in TaxAct. To whom they sell stocks bonds commodities regulated futures contracts foreign. This article will help you decide where to enter amounts and information from Form 1099-B Proceeds From Broker and Barter Exchange Transactions in Lacerte. Download Fillable Irs Form 1099-b In Pdf - The Latest Version Applicable For 2021. Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers gains and losses during a tax year. The full name of the IRS 1099-B Form is Proceeds from Broker and Barter Exchange Transactions The US Revenue Services follows all federal income transactions. The first three sections are separated based upon cost basis reporting regulations while the fourth section includes Regulated Futures Section 1256 contracts. TurboTax Premier searches for more than 400 tax deductions to make sure you get every credit and deduction you qualify for.

For whom they sold stocks commodities regulated futures contracts foreign currency contracts forward contracts debt instruments options securities futures contracts etc for cash. Generally these transactions are entered on the Dispositions screen for the tax type. Department Of The Treasury - Internal Revenue Service United States Federal Legal Forms And United States Legal Forms. Covered Securities with Short-Term gains or losses. 1099 b proceeds from broker and barter exchange transactions turbotax About Form 1099-B Proceeds from Broker and Barter Exchange Transactions A broker or barter exchange must file this form for each person. The 1099-B is used to report transactions for each person. Form 1099-B - Not Sent with Return to IRS Entries made directly on Federal Form 1099-B Proceeds From Broker and Barter Exchange Transactions or during the Investment Income section of the QA are only used to transfer information to Form 8949 Sales and Other Dispositions of Capital Assets and Schedule D Form 1040 Capital Gains and Losses. Brokers and barter exchanges must file a 1099-B for every person. IRS Form 1099-B - Form 1099-B reports the proceeds from any sales of non money market funds in non-retirement accounts and is used to calculate capital gains and losses. Click to see full answer. From within your TaxAct return Online or Desktop click Federal. For whom the broker has sold including short sales stocks commodities regulated futures contracts foreign currency contracts pursuant to a forward contract or regulated futures contract forward contracts debt instruments options securities futures contracts. If you are a broker or barter exchange including a QOF that is a broker or barter exchange complete Form 1099-B as usual for all dispositions of interests in QOFs.

Http Static Fmgsuite Com Media Documents Fc9b77dd E9bf 42bf 9f98 8f8f1c8f3ced Pdf

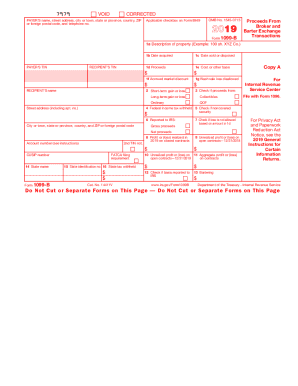

1099 b proceeds from broker and barter exchange transactions turbotax 7979 VOID CORRECTED PAYERS name street address city or town state or province country ZIP or foreign postal code and telephone no.

1099 b proceeds from broker and barter exchange transactions turbotax. 1545-0715 2019 Form 1099-B Proceeds From Broker and Barter Exchange Transactions 1a Description of property Example. A form 1099-B Proceeds From Broker and Barter Exchange Transactions is issued to taxpayers to whom the broker has sold including short sales. Open continue your return if its not already open.

If you sold stock bonds or other securities through a broker or had a barter exchange transaction exchanged property or services rather than paying cash you will likely receive a Form 1099-B. Proceeds from Broker and Barter Exchange Transactions. Fill Out The Proceeds From Broker And Barter Exchange Transactions Online And Print It Out For Free.

A broker or barter exchange must file Form 1099-B Proceeds From Broker and Barter Exchange Transactions for each person. 1099-B Proceeds from broker and barter exchange reporting is made up of four separate sub-sections on the 1099-B Summary Page. Click Investment Income to expand click Gain or loss on the sale of investments to.

S Corporate Screen 23. XYZ Co PAYERS TIN RECIPIENTS TIN 1b Date acquired 1c Date sold or. Heres where you enter or import your 1099-B in TurboTax.

Regardless of whether you had a gain loss or broke even you must report these transactions on your tax return. Applicable checkbox on Form 8949 OMB No. Proceeds from Broker and Barter Exchange Transactions - Form 1099-B.

Irs Form 1099-b Is Often Used In Us. Our 1099-B software makes it easy to import from excel print Copy B C 1 and 2 on plain paper with black ink and electronically file Form 1099-B to the IRS. A form 1099-B records all stock transactions and helps you report capital gains or losses to the IRS when you file your return.

1099 b proceeds from broker and barter exchange transactions turbotax A form 1099-B records all stock transactions and helps you report capital gains or losses to the IRS when you file your return.

1099 b proceeds from broker and barter exchange transactions turbotax. Our 1099-B software makes it easy to import from excel print Copy B C 1 and 2 on plain paper with black ink and electronically file Form 1099-B to the IRS. Irs Form 1099-b Is Often Used In Us. Proceeds from Broker and Barter Exchange Transactions - Form 1099-B. Applicable checkbox on Form 8949 OMB No. Regardless of whether you had a gain loss or broke even you must report these transactions on your tax return. Heres where you enter or import your 1099-B in TurboTax. XYZ Co PAYERS TIN RECIPIENTS TIN 1b Date acquired 1c Date sold or. S Corporate Screen 23. Click Investment Income to expand click Gain or loss on the sale of investments to. 1099-B Proceeds from broker and barter exchange reporting is made up of four separate sub-sections on the 1099-B Summary Page. A broker or barter exchange must file Form 1099-B Proceeds From Broker and Barter Exchange Transactions for each person.

Fill Out The Proceeds From Broker And Barter Exchange Transactions Online And Print It Out For Free. Proceeds from Broker and Barter Exchange Transactions. 1099 b proceeds from broker and barter exchange transactions turbotax If you sold stock bonds or other securities through a broker or had a barter exchange transaction exchanged property or services rather than paying cash you will likely receive a Form 1099-B. Open continue your return if its not already open. A form 1099-B Proceeds From Broker and Barter Exchange Transactions is issued to taxpayers to whom the broker has sold including short sales. 1545-0715 2019 Form 1099-B Proceeds From Broker and Barter Exchange Transactions 1a Description of property Example.

Proceeds From Broker And Barter Exchange Transactions Fill Out And Sign Printable Pdf Template Signnow

Proceeds From Broker And Barter Exchange Transactions Fill Out And Sign Printable Pdf Template Signnow