22++ Form 1099 B Proceeds From Broker And Barter Exchange Transactions Download

Form 1099 b proceeds from broker and barter exchange transactions. Capital gains and losses occur when a taxpayer sells a capital asset such as stocks bonds or the sale of your main home. Form 1099-B Proceeds from Broker and Barter Exchange Transactions reports important information about investment security sales. A broker or barter exchange must file Form 1099-B Proceeds From Broker and Barter Exchange Transactions for each person. Complete all boxes. If you are a broker or barter exchange including a QOF that is a broker or barter exchange complete Form 1099-B as usual for all dispositions of interests in QOFs. Screen depending on your return type. Download Fillable Irs Form 1099-b In Pdf - The Latest Version Applicable For 2021. Heres where you enter or import your 1099-B even if you did not get one in TurboTax. Department Of The Treasury - Internal Revenue Service United States Federal Legal Forms And United States Legal Forms. Form 1099-B - Cost Basis and Date Acquired The Form 1099-B Proceeds From Broker and Barter Exchange Transactions you receive may only report the date of the sale and the sales proceeds amount. People who participate in formal bartering networks may get a copy of the form too. What is a 1099-B.

Follow the specific instructions for brokers or barter exchanges for example the reporting of basis for a QOF investment that is a covered security. Brokers and barter exchanges must file a 1099-B for every person. Open continue your return if it isnt already open. Fiduciary Screen 22. Form 1099 b proceeds from broker and barter exchange transactions This article will help you determine where to enter amounts and information from Form 1099-B Proceeds From Broker and Barter Exchange Transactions in ProConnect Tax Online. Generally these transactions are entered on the Dispositions or Schedule D4797etc. This document is completed and sent in along with the traditional yearly federal tax documents. Proceeds from Broker and Barter Exchange Transactions. Form 1099-B Proceeds From Broker and Barter Exchange Transactions Form 1099-B reports proceeds from securities transactions including sales of stocks bonds short sales redemptions tenders and bond maturities. This article will help you decide where to enter amounts and information from Form 1099-B Proceeds From Broker and Barter Exchange Transactions in Lacerte. Open continue your return if its not already open. You receive a Form 1099-B from a broker or barter transaction. This information will also be reported to the IRS.

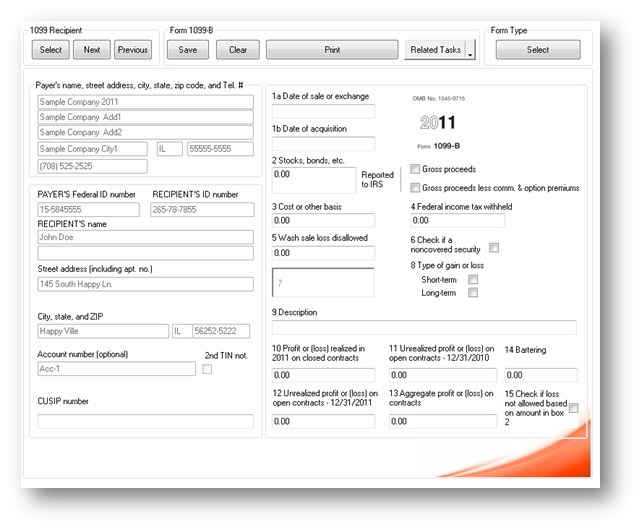

1099 B Software Proceeds From Broker And Barter Exchange Transactions

1099 B Software Proceeds From Broker And Barter Exchange Transactions

Form 1099 b proceeds from broker and barter exchange transactions A broker or barter exchange should report each transaction other than regulated futures foreign currency or Section 1256 option contracts on a separate Form 1099-B.

Form 1099 b proceeds from broker and barter exchange transactions. Navigation in this article is written out for individual returns but similar steps apply for. Form 1099-B Proceeds from Broker and Barter Exchange Transactions reports the sale of stocks bonds mutual funds and other securities. If you sell stocks bonds derivatives or other securities through a broker you can expect to receive one or more copies of Form 1099-B in January.

The information is generally reported on a Form 8949 andor a Schedule D as a capital gain or loss. 31 of the year following the tax year. This form is used to report gains or losses from such transactions in the preceding year.

Form 1099-B Proceeds from Broker and Barter Exchange Transactions reports the sale of stocks bonds mutual funds and other securities. S Corporate Screen 23. The broker or barter exchange must mail a copy of a 1099-B form to all clients by Jan.

Heres where you enter or import your 1099-B in TurboTax. One may also ask is bartering income taxable. Date of the purchase Date of the sale Description of the item sold Total proceeds If your broker withheld any federal tax.

A form 1099-B Proceeds From Broker and Barter Exchange Transactions is issued to taxpayers to whom the broker has sold including short sales. Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers gains and losses during a tax year. Proceeds from Broker and Barter Exchange Transactions - Form 1099-B A form 1099-B records all stock transactions and helps you report capital gains or losses to the IRS when you file your return.

Known as a Proceeds from Broker and Barter Exchange Transactions form it is used to estimate yearly earnings and deductions involved in certain activities such as. Form 1099-B is a tax form used to report proceeds from certain brokering transactions. By January 31 of each year the barter club will send you a Form 1099-B Proceeds from Broker and Barter Exchange Transactions This form shows the value of cash property services and credits that you received from exchanges during the previous year.

Fill Out The Proceeds From Broker And Barter Exchange Transactions Online And Print It Out For Free. 1099-B Proceeds From Broker and Barter Exchange Transaction Proceeds from broker and barter exchange provides the sales proceeds from multiple transactions including sales exchanges covered options and tender offers on page 2 of the Consolidate Forms 1099. Additionally profit and loss from futures is also reported on Form 1099-B.

For whom the broker has sold including short sales stocks commodities regulated futures contracts foreign currency contracts pursuant to a forward contract or regulated futures contract forward contracts debt instruments options securities futures contracts. Information on the 1099-B. Generally these transactions are entered on the Dispositions screen for the tax type.

Irs Form 1099-b Is Often Used In Us.

Form 1099 b proceeds from broker and barter exchange transactions Irs Form 1099-b Is Often Used In Us.

Form 1099 b proceeds from broker and barter exchange transactions. Generally these transactions are entered on the Dispositions screen for the tax type. Information on the 1099-B. For whom the broker has sold including short sales stocks commodities regulated futures contracts foreign currency contracts pursuant to a forward contract or regulated futures contract forward contracts debt instruments options securities futures contracts. Additionally profit and loss from futures is also reported on Form 1099-B. 1099-B Proceeds From Broker and Barter Exchange Transaction Proceeds from broker and barter exchange provides the sales proceeds from multiple transactions including sales exchanges covered options and tender offers on page 2 of the Consolidate Forms 1099. Fill Out The Proceeds From Broker And Barter Exchange Transactions Online And Print It Out For Free. By January 31 of each year the barter club will send you a Form 1099-B Proceeds from Broker and Barter Exchange Transactions This form shows the value of cash property services and credits that you received from exchanges during the previous year. Form 1099-B is a tax form used to report proceeds from certain brokering transactions. Known as a Proceeds from Broker and Barter Exchange Transactions form it is used to estimate yearly earnings and deductions involved in certain activities such as. Proceeds from Broker and Barter Exchange Transactions - Form 1099-B A form 1099-B records all stock transactions and helps you report capital gains or losses to the IRS when you file your return. Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers gains and losses during a tax year.

A form 1099-B Proceeds From Broker and Barter Exchange Transactions is issued to taxpayers to whom the broker has sold including short sales. Date of the purchase Date of the sale Description of the item sold Total proceeds If your broker withheld any federal tax. Form 1099 b proceeds from broker and barter exchange transactions One may also ask is bartering income taxable. Heres where you enter or import your 1099-B in TurboTax. The broker or barter exchange must mail a copy of a 1099-B form to all clients by Jan. S Corporate Screen 23. Form 1099-B Proceeds from Broker and Barter Exchange Transactions reports the sale of stocks bonds mutual funds and other securities. This form is used to report gains or losses from such transactions in the preceding year. 31 of the year following the tax year. The information is generally reported on a Form 8949 andor a Schedule D as a capital gain or loss. If you sell stocks bonds derivatives or other securities through a broker you can expect to receive one or more copies of Form 1099-B in January.

Deciphering Form 1099 B Novel Investor

Deciphering Form 1099 B Novel Investor

Form 1099-B Proceeds from Broker and Barter Exchange Transactions reports the sale of stocks bonds mutual funds and other securities. Navigation in this article is written out for individual returns but similar steps apply for. Form 1099 b proceeds from broker and barter exchange transactions.

Form 1099 b proceeds from broker and barter exchange transactions